Max 403b 2025 - What Is a 403(B)? 403(B) Explained Castle Wealth Group, 403 (b) contribution limits consist of two parts: Your total combined employee and employer match contribution limit. Unlocking Your Future The 403b Plan Guide, The elective deferral limit (the maximum amount an individual. 403 (b) contribution limits are the.

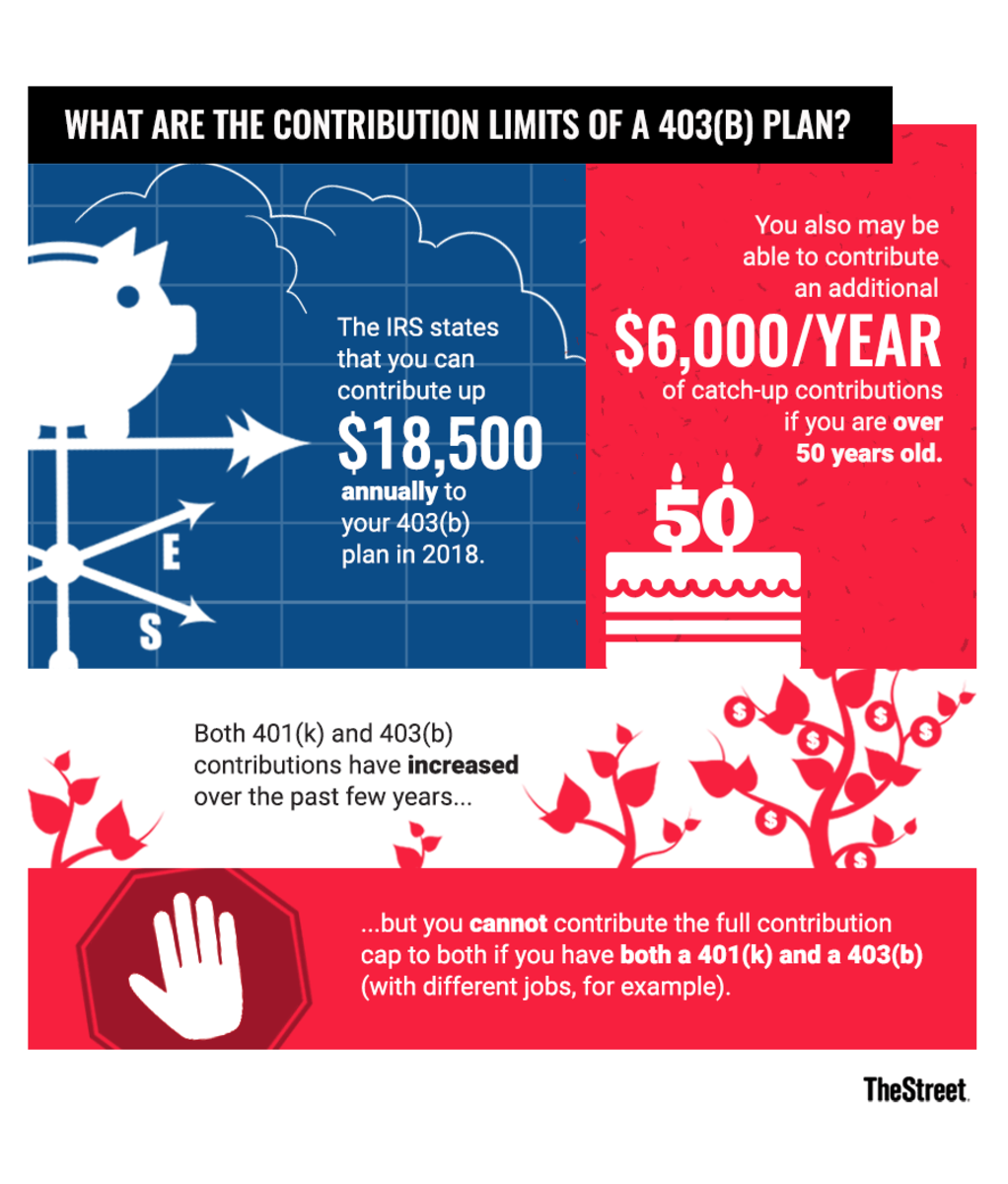

What Is a 403(B)? 403(B) Explained Castle Wealth Group, 403 (b) contribution limits consist of two parts: Your total combined employee and employer match contribution limit.

The internal revenue service (irs) is reminding employers that the annual contribution limit for their 403 (b) plans may require information from employees who.

What Is a 403(b) TaxSheltered Annuity Plan?, If you are under age 50, the annual contribution limit is $23,000. Find out how much you can save for retirement.

Maximum 403b 2025 Brita Colette, Workers can contribute up to $23,000 of their income to a 403 (b) plan, with an additional $7,500 allowed for workers 50 and older. Find out how much you can save for retirement.

The 2023 403 (b) contribution limit is $22,500 for pretax and roth employee contributions.

403b Max In 2025 Niki Teddie, Irs 401k 2025 contribution limit the irs sets various limits for retirement plans, including 401(k)s. The elective deferral limit (the maximum amount an individual.

.jpg)

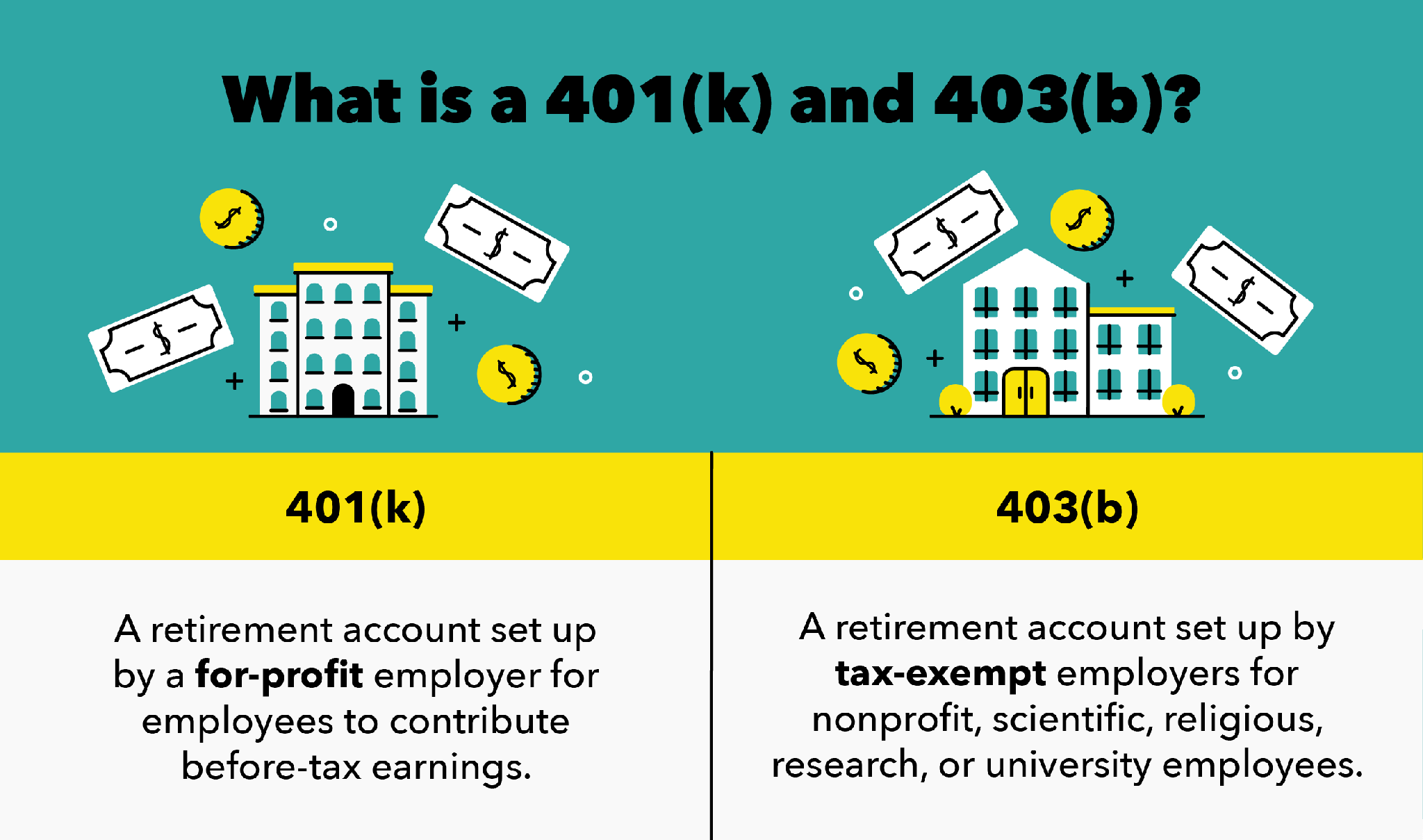

401(k) vs. 403b Chapter 7 What Is a 403b vs. 401(k)? WealthNews, 403 (b) contribution limits consist of two parts: The 401k/403b/457/tsp contribution limit is $22,500 in 2023.

Irs 401k 2025 contribution limit the irs sets various limits for retirement plans, including 401(k)s. The irs has announced the 2025 contribution limits for retirement savings accounts, including.

How Does 403b Plan Work and What is a 403b Plan Forex Lia, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2023. The internal revenue service (irs) is reminding employers that the annual contribution limit for their 403 (b) plans may require information from employees who.

How Does a 403(b) Plan Work?, Of note, the 2023 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $20,500 to $22,500. If you are under age 50, the annual contribution limit is $23,000.

Max 403b 2025. Your contribution and your employer’s contributions. It will go up by $500 to.